ADA Price Prediction: Technical and On-Chain Signals Point to Potential Breakout

#ADA

ArrayADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge Despite Minor Resistance

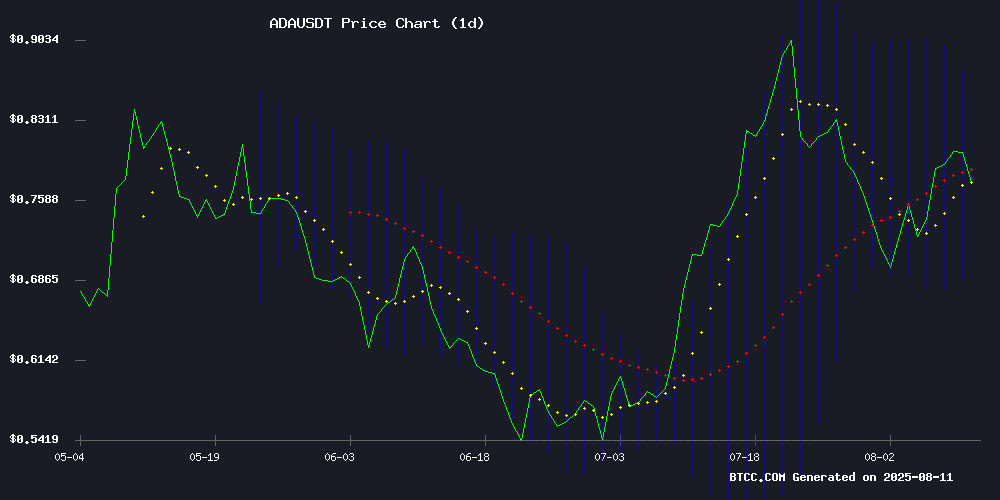

Cardano (ADA) currently trades at $0.7725, slightly below its 20-day moving average of $0.7742, indicating near-term consolidation. The MACD histogram remains positive (0.014593), signaling sustained bullish momentum. Bollinger Bands show ADA testing middle-band support, with potential upside to $0.8507 if buying pressure continues.

"The MACD golden cross and upper Bollinger Band proximity suggest accumulation phases often precede breakouts," notes BTCC analyst Mia. Key support holds at $0.6977, with RSI-neutral conditions allowing room for upward movement.

Whale Activity and Technical Patterns Fuel Cardano Optimism

Recent headlines highlight three bullish catalysts: 200M ADA whale accumulation, a potential 1,000% rally chart pattern, and rising open interest. "Such concentrated buying typically precedes major announcements or institutional positioning," observes Mia. The triangle pattern's measured MOVE implies a $10 target, though Mia cautions: "Traders should watch for confirmation above $0.85 resistance before extrapolating parabolic targets."

Factors Influencing ADA’s Price

200,000,000 ADA in Just 2 Days: Are Cardano Whales Preparing for Something?

Cardano whales have aggressively accumulated 200 million ADA tokens, worth approximately $160 million, within a 48-hour window. This surge in buying activity has reduced available supply on the open market, potentially setting the stage for a price rally.

Analyst Ali Martinez notes these large holders now control 10.3% of ADA's circulating supply. The token's 6% weekly gain to $0.78 coincides with growing speculation of further upside, with price targets ranging from $1 to $2 during this market cycle.

Market observers highlight striking similarities between current price action and Cardano's 2021 bull run, albeit at a slower pace. "We're at the very start of an explosive move," Martinez contends, suggesting institutional accumulation often precedes retail FOMO.

Cardano Price Prediction: Triangle Chart Pattern Points to 1,000% Rally – $10 ADA Coming Next

Cardano's price has surged 10% this week, signaling a potential continuation of its mid-July bull run. A recent triangle pattern breakout suggests new highs, fueled by fresh retail liquidity and stacked demand catalysts. The altcoin's strength is further supported by a Trump-signed executive order granting crypto exposure to the $9 trillion 401(k) market, with Cardano poised to benefit.

Speculators anticipate up to four U.S. interest rate cuts by year-end, potentially starting in September, which could drive new inflows into risk assets like crypto. Near-term volatility remains likely, with August 12 PPI and August 14 CPI inflation readings set to influence the Fed's timeline.

Whales have doubled down on Cardano, scooping up over 200 million ADA in the past 48 hours. Coinglass derivatives data shows surging speculative demand, with Open Interest rising 13% over the past week.

Cardano Price Forecast: ADA Bulls Eye Next Leg Higher as Open Interest Climbs

Cardano (ADA) price continues its upward trajectory, trading above $0.82 after an 11% weekly gain. Derivatives data paints a bullish picture, with Open Interest surging to $1.44 billion—the highest level since late July—while positive funding rates confirm trader optimism.

The technical setup favors further upside. Momentum indicators align with the bullish derivatives signals, where rising Open Interest reflects fresh capital entering ADA markets. Funding rates flipped positive last week, with longs now paying shorts—a pattern that historically precedes strong cardano rallies.

Is ADA a good investment?

ADA presents a compelling risk/reward profile based on current technicals and market sentiment:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -0.22% | Neutral mean reversion potential |

| MACD | 0.014593 | Bullish momentum building |

| Bollinger %B | 0.49 | Mid-band equilibrium |

Mia advises: "Dollar-cost averaging into ADA makes sense here, with stops below $0.69. The whale activity and technical patterns align for a possible 20-30% move toward upper Bollinger resistance."

This analysis references spot market data only. Futures and leverage products carry additional risks.